General Electric (GE) is a well-known name among investors, and its stock performance often draws significant attention. In recent times, the relationship between GE stock and financial news platform FintechZoom has piqued interest due to its impact on market trends. This article delves into exploring the connection between GE stock and FintechZoom, shedding light on how developments in one can influence the other and the broader market landscape.

Exploring the Relationship and Market Trends

Understanding GE Stock FintechZoom Performance

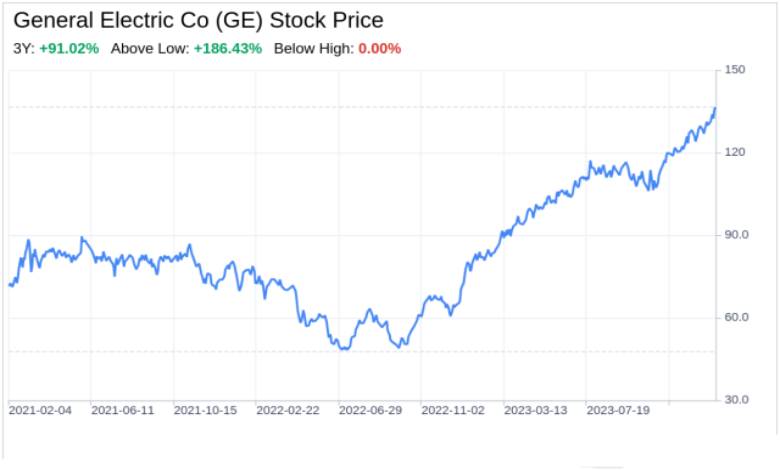

General Electric, a conglomerate with diverse business segments, has a long history of being a key player in industrial and technological sectors. The performance of GE stock is closely monitored by investors, analysts, and market enthusiasts due to its significance in reflecting broader economic trends. Factors such as company earnings, global economic conditions, and industry-specific developments can all influence the price movements of GE stock.

FintechZoom: A Hub for Financial News

FintechZoom is a prominent online platform known for its comprehensive coverage of financial news, market analysis, and investment insights. With a focus on delivering real-time updates and in-depth articles on various companies and industries, FintechZoom has become a go-to source for investors seeking reliable information to make informed decisions. The platform’s reach and credibility make it a valuable resource for tracking market trends and stock performance.

The Intersection of GE Stock and FintechZoom

The relationship between GE stock and FintechZoom lies in the way financial news and analysis provided by the platform can impact investor sentiment and, consequently, stock prices. Articles, reports, and commentaries published on FintechZoom regarding GE’s financial health, strategic moves, or industry outlook can influence how investors perceive the company and its stock. Positive coverage may attract more buyers, leading to an uptick in GE stock price, while negative news could trigger selling pressure.

Market Trends and Sentiment Analysis

Monitoring GE stock on FintechZoom can provide valuable insights into broader market trends and investor sentiment. By analyzing the tone of articles, expert opinions, and market reactions shared on the platform, one can gauge the prevailing outlook towards GE stock. Trends such as increasing interest from institutional investors, changes in trading volume, or shifts in options activity can all signal potential movements in GE stock price.

The relationship between GE stock and FintechZoom is a dynamic one that underscores the interconnected nature of financial markets and media coverage. Keeping abreast of developments on FintechZoom can offer investors a well-rounded view of GE stock performance, helping them make more informed investment decisions. By understanding how news and analysis on FintechZoom influence market sentiment, investors can navigate the complexities of the stock market with greater confidence.

For more information on GE stock and market insights, visit FintechZoom.

Leveraging Fintech Innovation to Enhance Investment Strategies in Today’s Market

Fintech innovations have become instrumental in reshaping and optimizing investment strategies in today’s dynamic market landscape. Leveraging these technological advancements offers investors a competitive edge by enabling them to make more informed decisions, manage risks effectively, and seize lucrative opportunities promptly. As financial technology continues to revolutionize the way investments are made and managed, it is crucial for market participants to stay informed and adapt to these changes proactively. Let’s delve into how fintech innovation can enhance investment strategies in the contemporary market scenario.

Fintech Solutions for Data Analysis and Insights

One of the significant advantages of fintech in investment strategies is its ability to process vast amounts of data rapidly. Fintech tools can analyze market trends, track asset performance, and provide valuable insights to investors in real time. By leveraging data analytics and machine learning algorithms, investors can make more informed decisions based on data-driven evidence rather than relying solely on intuition.

Automation and Algorithmic Trading

Automation plays a pivotal role in streamlining investment processes and reducing manual errors. Fintech solutions enable automated trading based on predefined criteria and algorithms. This not only increases the efficiency of executing trades but also helps in minimizing emotional biases that can impact investment decisions. Algorithmic trading powered by fintech algorithms can capitalize on market opportunities promptly and execute trades at optimal prices.

Robo-Advisors and Personalized Portfolio Management

Robo-advisors have gained significant popularity in recent years by offering automated, algorithm-driven financial planning services. These digital platforms utilize fintech algorithms to provide personalized investment recommendations based on an individual’s financial goals, risk tolerance, and investment horizon. By leveraging robo-advisory services, investors can access diversified portfolios and rebalancing strategies tailored to their specific needs.

Blockchain Technology for Security and Transparency

Blockchain technology has introduced a new level of security and transparency to the investment landscape. By utilizing distributed ledger technology, fintech companies can enhance the security of transactions, reduce fraud risks, and ensure the immutability of investment records. Smart contracts powered by blockchain enable secure and automated execution of investment agreements, improving trust and efficiency in the investment process.

Real-Time Portfolio Monitoring and Risk Management

Fintech tools provide investors with the capability to monitor their portfolios in real time and assess risk exposures promptly. By utilizing interactive dashboards and risk management algorithms, investors can identify potential risks, diversify their holdings effectively, and adjust their investment strategies accordingly. Real-time portfolio monitoring empowers investors to stay agile in response to market fluctuations and evolving economic conditions.

The integration of fintech innovation into investment strategies offers transformative benefits in terms of data analysis, automation, personalized portfolio management, security, and risk management. By embracing fintech solutions, investors can navigate the complexities of today’s market landscape with greater precision, efficiency, and resilience. Staying abreast of the latest fintech trends and leveraging innovative tools will be key to achieving sustainable growth and success in the ever-evolving world of investments.

Conclusion

The relationship between GE stock and FintechZoom underscores the importance of leveraging fintech innovations for informed investment strategies. Fintech platforms like FintechZoom provide real-time data and analysis, enabling investors to stay ahead of market trends and make timely decisions. By integrating fintech tools such as data analytics and AI, investors can optimize their portfolios and capitalize on market opportunities swiftly. This symbiotic relationship reflects the fusion of traditional finance with cutting-edge technology, empowering investors to navigate the dynamic market landscape with confidence and agility.

Hey there! I’m Dyna, the author of Baddiehub.lol. For 9 years, I’ve been in the tech world, focusing on the latest technological growth in our daily tech life. My mission? Provide clear guides on everything from streaming devices to card activations. I’m all about guiding you step-by-step through any process. With my guides, you’re always on the right path.